- 877-241-5144

- M-F: 8am to 8pm

- 877-241-5144

- M-F: 8am to 8pm

Appraisal Ordering Process

Home » Appraisers » Appraisal Ordering Process

The Appraisal Ordering Process at AmeriMac

At AmeriMac, our appraisal ordering and appraiser selection process is unique and focused on quality.

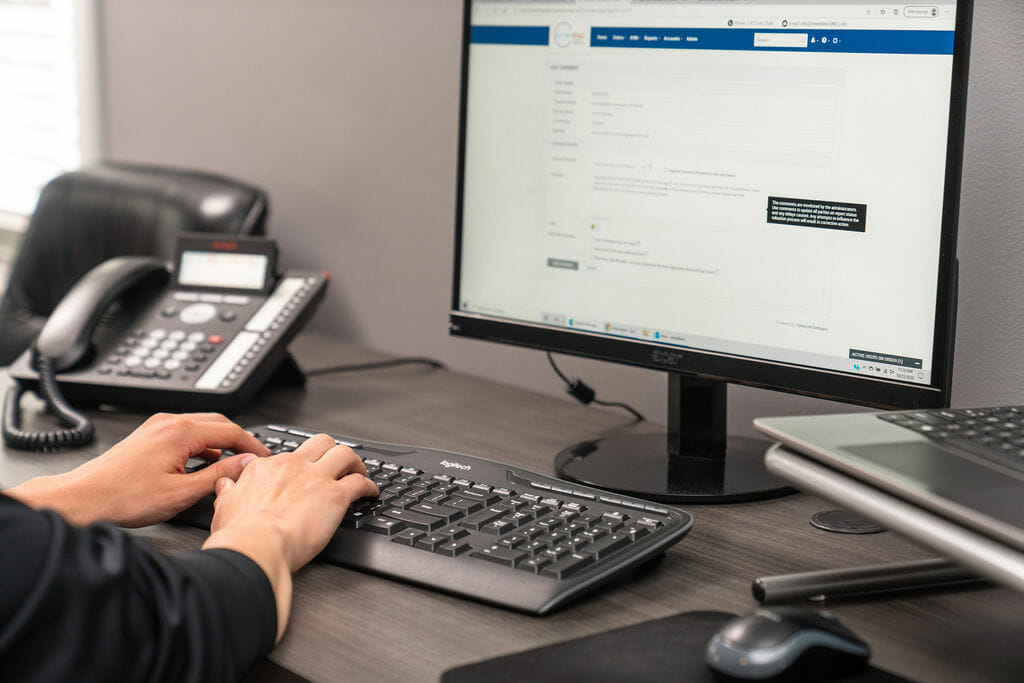

- When a lender client places an order through our Value Link portal, our team immediately receives and reviews the details.

- We assign the order to an appraiser that best fits the order needs within the requested time frame.

- The appraiser accepts the order with the due-date and submits a price. Inside the portal, the appraiser is able to accept, decline, or request a change.

- Our AmeriMac team accepts the order terms or we assign the order to another qualified appraiser. All of this happens within a few hours.

- The appraiser is required to contact the borrower as soon as possible after acceptance. We follow up to ensure this contact has been made.

- Our AmeriMac team will then follow up with the lender to let him or her know the appraisal is scheduled.

- When the completed appraisal is added to the portal, our AmeriMac team conducts a 63-point quality assurance check to ensure the appraisal is accurate and compliant. If at this time we see any revisions to be made, we will work with the appraiser to make those changes prior to sending it to the client.

- Once we have approved the appraisal, we send the completed report to the lender for review.

How We Assign Appraisal Orders

With each appraisal order, we take great care in assigning the order to an expert from our appraiser panel. Our appraisers are hand-selected based on their:

- Knowledge of the geographical proximity

- Record for completing compliant appraisals

- Low revision history

- Ability to submit a report within our required turn-time

- History of communication with our team throughout the process

We keep track of these criteria through their member appraisal profile which includes this historical performance information and their geographical coverage areas.

Compliance, Regulatory Standards, and Our Appraisers

An important aspect of the appraisal industry is to be in compliance with the guidelines set forth by regulatory bodies. Legislation enacted in 2010 following the Great Recession called for impartiality between the lending group and the appraiser. These requirements, like those that appear in the Dodd-Frank Act, include a clear separation of the lending and valuation process.

The facilitation of this level of separation is best conducted by appraisal management companies like AmeriMac, who make staying up to date with these regulations a full-time job. AmeriMac selects appraisers that are well-informed on appraisal regulations and requirements to deliver accurate and compliant appraisal services consistently.

AmeriMac Quality Control Management

To maintain further integration with regulatory compliance, and to ensure lender satisfaction, AmeriMac utilizes constant quality control measures. All of our appraisal reports are inspected against our rigorous 63-point checklist in compliance with USPAP and other regulatory requirements. Our quality control methodology also helps minimize the likelihood of potential errors that could delay turn times in underwriting. We invite appraisers to work with us that share our high standards and continue to elevate our appraisal service.

Register to Become AmeriMac Appraiser

10 Reasons to Choose AmeriMac

Our Appraisal Ordering Process

Our Commitment to Compliance

Read Our 5-Star Reviews

Connect with AmeriMac Appraisal Management Today

The fully staffed customer service department at Amerimac Appraisal Management is available Monday through Friday, 8 a.m. EST to 8 p.m. EST.

SIGNUP FOR OUR MONTHLY NEWSLETTER:

Client Testimonials

© Amerimac 2025. Privacy Policy. Website by Whiteboard Marketing.